With rising prices for housing and goods, a larger number of single-parent households and increased female participation in the workforce, the number of young families with stay-at-home parents is far below that of previous generations. Unlike in decades past, today, 73 percent of families with children under 18 must rely on some form of child care. In these families, either both parents are in the labor force, or in the case of single-parent families, the one parent is in the labor force.

The importance of quality child care cannot be overstated. Researchers at Harvard have found that the human brain undergoes its most rapid development within the first few years of a child’s life. Over time, the brain loses much of its ability to adapt to new challenges and create new neural connections associated with learning, which means that early childhood care and education can have lasting impacts.

Consistent with these findings, other studies have shown that individuals who receive high-quality child care experience higher levels of academic achievement, increased income potential, and overall improved socioeconomic and health outcomes in adulthood.

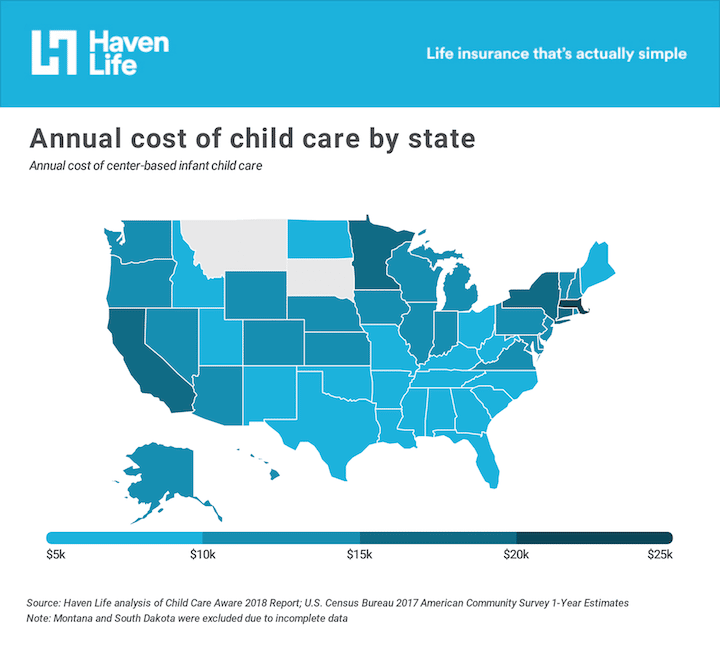

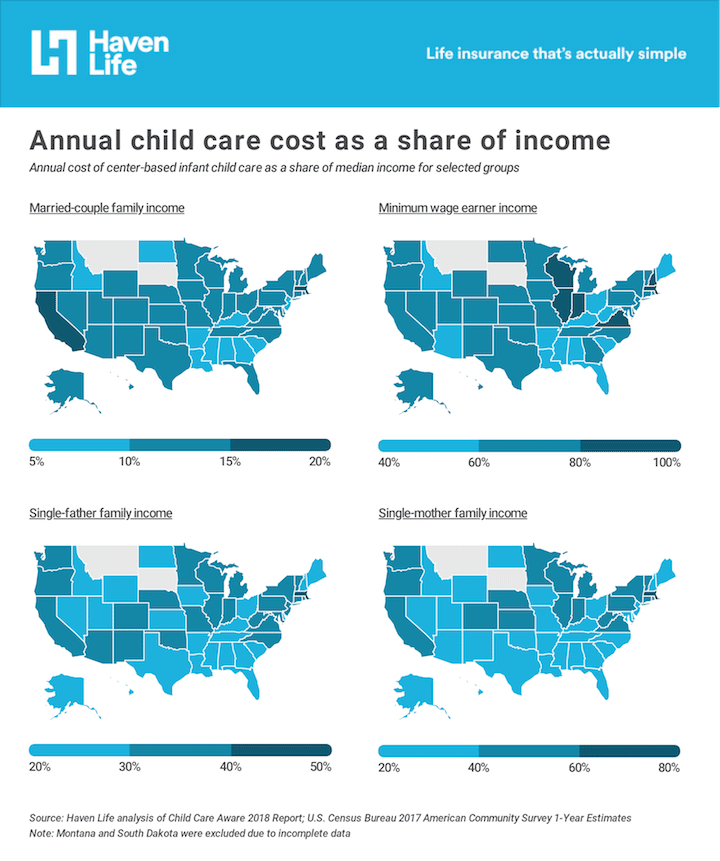

Despite the benefits, the unfortunate reality is that families across the country lack access to affordable child care options. According to Child Care Aware, the average annual cost of center-based infant care in the U.S. is $11,959. This amount accounts for more than 12 percent of the median married-couple family income—well above the Department of Health and Human Services’ (HHS) recommendation that child care should cost no more than 7 percent of household income.

According to Haven Life’s analysis of Child Care Aware, U.S. Census and U.S. Department of Labor data, single parents (especially single moms) and minimum wage earners are hit even harder. The average annual cost of center-based infant care accounts for 28.1 percent of the median income for single-fathers, 42.9 percent for single moms, and 79 percent for minimum wage earners. Furthermore, as a generation, millennials in most states struggle to pay for child care, and the high cost of raising children is a reason many report not having kids.

Despite a strong need for reform, some states offer better opportunities for affordable child care than others. To help parents better plan for their future, Haven Life compiled data on child care cost by state and how it compares to various income thresholds.

Based on the 7 percent HHS recommendation, child care is only considered affordable for the typical married-couple family in two states (Mississippi and Alabama), in no states for single parents, and also in no states for minimum wage earners. Southern states such as Mississippi, Alabama, South Carolina and Louisiana tend to have the lowest child care costs, while coastal states such as Massachusetts, New York, and California have the highest. Below is the full list of child care costs by state.

Child care cost by state

Alabama

- Annual cost of child care: $5,858

- As a share of married-couple family income: 6.9 percent of $84,734

- As a share of single-father income: 15.8 percent of $37,067

- As a share of single-mother income: 27.6 percent of $21,201

- As a share of minimum wage income: 38.7 percent of $15,131

Alaska

- Annual cost of child care: $11,832

- As a share of married-couple family income: 11.8 percent of $100,499

- As a share of single-father income: 22.1 percent of $53,554

- As a share of single-mother income: 33.6 percent of $35,232

- As a share of minimum wage income: 57.3 percent of $20,640

Arizona

- Annual cost of child care: $10,687

- As a share of married-couple family income: 12.5 percent of $85,782

- As a share of single-father income: 26.1 percent of $40,952

- As a share of single-mother income: 36.4 percent of $29,359

- As a share of minimum wage income: 46.6 percent of $22,957

Arkansas

- Annual cost of child care: $6,726

- As a share of married-couple family income: 8.9 percent of $75,914

- As a share of single-father income: 18.7 percent of $36,002

- As a share of single-mother income: 27.1 percent of $24,804

- As a share of minimum wage income: 34.8 percent of $19,305

California

- Annual cost of child care: $16,542

- As a share of married-couple family income: 16.4 percent of $101,026

- As a share of single-father income: 34.7 percent of $47,637

- As a share of single-mother income: 52.4 percent of $31,567

- As a share of minimum wage income: 72.1 percent of $22,957

Colorado

- Annual cost of child care: $14,960

- As a share of married-couple family income: 14.7 percent of $101,844

- As a share of single-father income: 27.1 percent of $55,273

- As a share of single-mother income: 42.8 percent of $34,937

- As a share of minimum wage income: 64.6 percent of $23,166

Connecticut

- Annual cost of child care: $15,132

- As a share of married-couple family income: 12.4 percent of $122,525

- As a share of single-father income: 29.4 percent of $51,455

- As a share of single-mother income: 46.1 percent of $32,837

- As a share of minimum wage income: 71.8 percent of $21,079

Delaware

- Annual cost of child care: $10,759

- As a share of married-couple family income: 10.9 percent of $98,600

- As a share of single-father income: 24.6 percent of $43,812

- As a share of single-mother income: 34.6 percent of $31,075

- As a share of minimum wage income: 58.9 percent of $18,261

Florida

- Annual cost of child care: $9,018

- As a share of married-couple family income: 11.0 percent of $82,041

- As a share of single-father income: 22.3 percent of $40,370

- As a share of single-mother income: 32.4 percent of $27,874

- As a share of minimum wage income: 51.1 percent of $17,656

Georgia

- Annual cost of child care: $8,327

- As a share of married-couple family income: 9.2 percent of $90,104

- As a share of single-father income: 20.3 percent of $41,006

- As a share of single-mother income: 30.3 percent of $27,467

- As a share of minimum wage income: 55.0 percent of $15,131

Hawaii

- Annual cost of child care: $13,404

- As a share of married-couple family income: 12.9 percent of $103,541

- As a share of single-father income: 23.6 percent of $56,772

- As a share of single-mother income: 37.3 percent of $35,901

- As a share of minimum wage income: 63.6 percent of $21,079

Idaho

- Annual cost of child care: $7,296

- As a share of married-couple family income: 9.7 percent of $75,263

- As a share of single-father income: 20.2 percent of $36,034

- As a share of single-mother income: 28.1 percent of $25,962

- As a share of minimum wage income: 48.2 percent of $15,131

Illinois

- Annual cost of child care: $13,474

- As a share of married-couple family income: 13.3 percent of $100,936

- As a share of single-father income: 32.2 percent of $41,843

- As a share of single-mother income: 47.6 percent of $28,327

- As a share of minimum wage income: 78.3 percent of $17,218

Indiana

- Annual cost of child care: $12,312

- As a share of married-couple family income: 13.8 percent of $89,198

- As a share of single-father income: 28.8 percent of $42,814

- As a share of single-mother income: 48.0 percent of $25,639

- As a share of minimum wage income: 81.4 percent of $15,131

Iowa

- Annual cost of child care: $10,131

- As a share of married-couple family income: 10.7 percent of $94,591

- As a share of single-father income: 23.4 percent of $43,368

- As a share of single-mother income: 35.0 percent of $28,924

- As a share of minimum wage income: 67.0 percent of $15,131

Kansas

- Annual cost of child care: $10,955

- As a share of married-couple family income: 12.4 percent of $88,524

- As a share of single-father income: 24.2 percent of $45,309

- As a share of single-mother income: 40.7 percent of $26,926

- As a share of minimum wage income: 72.4 percent of $15,131

Kentucky

- Annual cost of child care: $6,258

- As a share of married-couple family income: 7.5 percent of $83,847

- As a share of single-father income: 16.7 percent of $37,434

- As a share of single-mother income: 27.2 percent of $22,994

- As a share of minimum wage income: 41.4 percent of $15,131

Louisiana

- Annual cost of child care: $7,540

- As a share of married-couple family income: 8.2 percent of $91,725

- As a share of single-father income: 18.6 percent of $40,511

- As a share of single-mother income: 36.0 percent of $20,951

- As a share of minimum wage income: 49.8 percent of $15,131

Maine

- Annual cost of child care: $9,224

- As a share of married-couple family income: 10.0 percent of $92,172

- As a share of single-father income: 22.8 percent of $40,392

- As a share of single-mother income: 30.9 percent of $29,838

- As a share of minimum wage income: 40.2 percent of $22,957

Maryland

- Annual cost of child care: $14,970

- As a share of married-couple family income: 11.9 percent of $125,988

- As a share of single-father income: 28.6 percent of $52,355

- As a share of single-mother income: 38.5 percent of $38,867

- As a share of minimum wage income: 71.0 percent of $21,079

Massachusetts

- Annual cost of child care: $20,415

- As a share of married-couple family income: 15.1 percent of $134,915

- As a share of single-father income: 38.1 percent of $53,555

- As a share of single-mother income: 64.9 percent of $31,463

- As a share of minimum wage income: 81.5 percent of $25,044

Michigan

- Annual cost of child care: $10,603

- As a share of married-couple family income: 11.4 percent of $92,792

- As a share of single-father income: 27.9 percent of $37,979

- As a share of single-mother income: 40.3 percent of $26,283

- As a share of minimum wage income: 54.9 percent of $19,305

Minnesota

- Annual cost of child care: $15,704

- As a share of married-couple family income: 14.1 percent of $111,045

- As a share of single-father income: 31.0 percent of $50,615

- As a share of single-mother income: 44.7 percent of $35,128

- As a share of minimum wage income: 76.3 percent of $20,578

Mississippi

- Annual cost of child care: $5,307

- As a share of married-couple family income: 6.8 percent of $77,740

- As a share of single-father income: 14.9 percent of $35,518

- As a share of single-mother income: 25.5 percent of $20,818

- As a share of minimum wage income: 35.1 percent of $15,131

Missouri

- Annual cost of child care: $9,802

- As a share of married-couple family income: 11.0 percent of $89,229

- As a share of single-father income: 25.3 percent of $38,671

- As a share of single-mother income: 36.8 percent of $26,672

- As a share of minimum wage income: 54.6 percent of $17,948

Nebraska

- Annual cost of child care: $12,272

- As a share of married-couple family income: 13.4 percent of $91,646

- As a share of single-father income: 28.1 percent of $43,701

- As a share of single-mother income: 45.6 percent of $26,926

- As a share of minimum wage income: 65.3 percent of $18,783

Nevada

- Annual cost of child care: $11,137

- As a share of married-couple family income: 13.1 percent of $85,235

- As a share of single-father income: 23.3 percent of $47,772

- As a share of single-mother income: 35.3 percent of $31,570

- As a share of minimum wage income: 64.7 percent of $17,218

New Hampshire

- Annual cost of child care: $12,487

- As a share of married-couple family income: 10.5 percent of $118,603

- As a share of single-father income: 22.8 percent of $54,778

- As a share of single-mother income: 39.5 percent of $31,584

- As a share of minimum wage income: 82.5 percent of $15,131

New Jersey

- Annual cost of child care: $12,679

- As a share of married-couple family income: 9.9 percent of $127,504

- As a share of single-father income: 25.0 percent of $50,752

- As a share of single-mother income: 38.8 percent of $32,707

- As a share of minimum wage income: 68.6 percent of $18,470

New Mexico

- Annual cost of child care: $8,412

- As a share of married-couple family income: 10.5 percent of $80,057

- As a share of single-father income: 25.9 percent of $32,460

- As a share of single-mother income: 34.5 percent of $24,361

- As a share of minimum wage income: 53.7 percent of $15,653

New York

- Annual cost of child care: $15,028

- As a share of married-couple family income: 14.3 percent of $105,088

- As a share of single-father income: 35.4 percent of $42,440

- As a share of single-mother income: 51.7 percent of $29,059

- As a share of minimum wage income: 64.9 percent of $23,166

North Carolina

- Annual cost of child care: $9,254

- As a share of married-couple family income: 10.4 percent of $88,784

- As a share of single-father income: 25.0 percent of $36,978

- As a share of single-mother income: 34.7 percent of $26,692

- As a share of minimum wage income: 61.2 percent of $15,131

North Dakota

- Annual cost of child care: $8,875

- As a share of married-couple family income: 8.8 percent of $101,039

- As a share of single-father income: 18.7 percent of $47,496

- As a share of single-mother income: 32.3 percent of $27,470

- As a share of minimum wage income: 58.7 percent of $15,131

Ohio

- Annual cost of child care: $9,466

- As a share of married-couple family income: 10.0 percent of $95,134

- As a share of single-father income: 23.0 percent of $41,090

- As a share of single-mother income: 37.9 percent of $24,968

- As a share of minimum wage income: 53.0 percent of $17,844

Oklahoma

- Annual cost of child care: $8,372

- As a share of married-couple family income: 10.7 percent of $78,578

- As a share of single-father income: 24.7 percent of $33,957

- As a share of single-mother income: 33.4 percent of $25,050

- As a share of minimum wage income: 55.3 percent of $15,131

Oregon

- Annual cost of child care: $13,292

- As a share of married-couple family income: 14.6 percent of $90,941

- As a share of single-father income: 33.5 percent of $39,713

- As a share of single-mother income: 46.4 percent of $28,664

- As a share of minimum wage income: 59.2 percent of $22,435

Pennsylvania

- Annual cost of child care: $11,560

- As a share of married-couple family income: 11.4 percent of $101,115

- As a share of single-father income: 25.4 percent of $45,543

- As a share of single-mother income: 41.6 percent of $27,788

- As a share of minimum wage income: 76.4 percent of $15,131

Rhode Island

- Annual cost of child care: $13,370

- As a share of married-couple family income: 13.0 percent of $103,063

- As a share of single-father income: 30.1 percent of $44,357

- As a share of single-mother income: 48.3 percent of $27,699

- As a share of minimum wage income: 61.0 percent of $21,914

South Carolina

- Annual cost of child care: $6,840

- As a share of married-couple family income: 7.9 percent of $86,299

- As a share of single-father income: 19.0 percent of $35,937

- As a share of single-mother income: 27.9 percent of $24,544

- As a share of minimum wage income: 45.2 percent of $15,131

Tennessee

- Annual cost of child care: $8,524

- As a share of married-couple family income: 10.3 percent of $82,906

- As a share of single-father income: 23.2 percent of $36,683

- As a share of single-mother income: 34.4 percent of $24,751

- As a share of minimum wage income: 56.3 percent of $15,131

Texas

- Annual cost of child care: $9,102

- As a share of married-couple family income: 10.3 percent of $88,529

- As a share of single-father income: 21.9 percent of $41,504

- As a share of single-mother income: 33.3 percent of $27,344

- As a share of minimum wage income: 60.2 percent of $15,131

Utah

- Annual cost of child care: $9,708

- As a share of married-couple family income: 10.9 percent of $89,392

- As a share of single-father income: 17.3 percent of $56,138

- As a share of single-mother income: 30.6 percent of $31,689

- As a share of minimum wage income: 64.2 percent of $15,131

Vermont

- Annual cost of child care: $12,507

- As a share of married-couple family income: 14.0 percent of $89,058

- As a share of single-father income: 31.6 percent of $39,607

- As a share of single-mother income: 43.9 percent of $28,477

- As a share of minimum wage income: 55.6 percent of $22,498

Virginia

- Annual cost of child care: $13,728

- As a share of married-couple family income: 12.4 percent of $110,720

- As a share of single-father income: 28.0 percent of $49,079

- As a share of single-mother income: 43.5 percent of $31,570

- As a share of minimum wage income: 90.7 percent of $15,131

Washington

- Annual cost of child care: $14,208

- As a share of married-couple family income: 13.7 percent of $103,520

- As a share of single-father income: 27.9 percent of $51,010

- As a share of single-mother income: 45.8 percent of $30,991

- As a share of minimum wage income: 56.7 percent of $25,044

West Virginia

- Annual cost of child care: $8,528

- As a share of married-couple family income: 11.0 percent of $77,244

- As a share of single-father income: 25.1 percent of $33,968

- As a share of single-mother income: 49.5 percent of $17,215

- As a share of minimum wage income: 46.7 percent of $18,261

Wisconsin

- Annual cost of child care: $12,268

- As a share of married-couple family income: 12.2 percent of $100,160

- As a share of single-father income: 27.4 percent of $44,693

- As a share of single-mother income: 42.2 percent of $29,080

- As a share of minimum wage income: 81.1 percent of $15,131

Wyoming

- Annual cost of child care: $10,394

- As a share of married-couple family income: 11.7 percent of $88,781

- As a share of single-father income: 17.6 percent of $59,141

- As a share of single-mother income: 33.3 percent of $31,201

- As a share of minimum wage income: 68.7 percent of $15,131

District of Columbia

- Annual cost of child care: $23,666

- As a share of married-couple family income: 12.6 percent of $187,764

- As a share of single-father income: 43.9 percent of $53,924

- As a share of single-mother income: 100.6 percent of $23,528

- As a share of minimum wage income: 85.6 percent of $27,653

Methodology

The annual cost of child care used in this analysis is from the Child Care Aware 2018 Report: The U.S. and the High Cost of Child Care. For each state, this analysis considered the annual cost of infant care at a child care center. Child Care Aware does not report this data for Montana or South Dakota.

Data on median family income, median single-father income, and median single-mother income comes from the U.S. Census Bureau 2017 American Community Survey 1-Year Estimates. Income data is for family households with children under 18.

Minimum wage data is from the U.S. Department of Labor, effective Jan. 1, 2019. The federal minimum wage was assigned to states without state-specific minimum wages. To calculate the annual income of a single minimum wage earner, the hourly wage was multiplied by 2,087 hours per year, which is the standard used by the U.S. Office of Personnel Management.

Haven Life Insurance Agency LLC (Haven Life) conducted this research for educational/informational purposes only. Haven Life is an online life insurance agency offering term life insurance issued by Massachusetts Mutual Life Insurance Company. Haven Life does not provide tax, legal, investment, or housing/real estate advice, and the information in the study should not be relied on as such. You should consult your own tax, legal, investment, and other advisors, as appropriate, before engaging in any transaction.

The post High child care costs put strain on American families in every state appeared first on Blog | Haven Life | Life insurance & Personal Finance Tips.

from Blog | Haven Life | Life insurance & Personal Finance Tips https://ift.tt/2U8F0YP

ConversionConversion EmoticonEmoticon